Many Malaysians will soon receive support from the Prihatin Rakyat economic stimulus package, providing relief from the economic hit of the COVID-19 crisis. The stimulus package is a welcome assistance for some, but it may not stretch far enough for others.

Getting personal financing may help fill that gap. Available from banks, cooperatives and licensed credit agencies, unsecured personal loans come in amounts starting around RM2,000, going up to RM200,000.

REMARK (15th April 2020): Despite the availability of banking services during the MCO, the processing time for financing applications may experience some delays. Certain services that are crucial in the evaluation and approval of financing applications, are currently experiencing service disruptions.

But is now a good time to get personal financing? In normal times, you’d consider the interest rate as a primary deciding factor — and you’d compare different products from multiple financial institutions to get the lowest rate. But now, in challenging times and less steady incomes, there are additional questions to ask.

1. Will I qualify for Personal Financing?

We’re not sure if banks will increase any of the application requirements, making it more difficult for some borrowers to qualify for a loan or get a low rate. It’s just prudent to shop around for a product is now more important than ever.

Banks: Banks tend to have higher credit and income standards for non-customers, but if your bank is among those that offer personal loans, you may have access to lower rates and special features. Banks tend to react to given circumstances faster than other financial institutions, so check and see if there any special promotions like rebates and even if the moratorium applies to newly approved financing.

Credit Cooperatives: Cooperative loans i(commonly known in the Malay language as Pinjaman Koperasi) are credit services offered by cooperatives registered under the Cooperative Commission of Malaysia (SKM) to their members who work as civil servants. It is part of the shadow banking system in Malaysia. There are some co-ops that offer to non-members aw well. If you work in a GLC (Government Linked Company) you may also qualify to apply for financing from a credit cooperative.

Licensed Credit Agencies: Unlike commercial banks, licensed moneylenders offer loans out of their own capital at a rate capped by the Moneylenders Act 1951. They are only entitled to charge simple interest between 12% to 18% per annum depending on whether security for the loan is provided or not. They are also more flexible than banks with income requirements.

Other options to help you qualify: If a friend or family member is willing to co-sign a personal loan, adding them to a loan application can help your chances of approval or get you a lower interest rate. You can also apply for a secured loan, which lets you pledge something you own or a savings account to borrow the money. If you fail to repay the loan, though, the bank could take your asset.

2. Is personal financing a good idea?

Under normal circumstances, personal financing is a good idea when it’s used to improve your financial position and you can commit to paying it back without stressing your budget. For example, a debt consolidation loan, combines high-interest debts into a single payment and can help you pay off debt faster.

In a crisis, a personal loan can be used to pay bills like rent, utilities or medical costs. But it is an expensive option and should be considered only after exhausting other options.

Do remember, unsecured personal financing is designed to be used for anything, so if you have a large, unexpected expense and you need the money quickly, it may make sense during a crisis to consider this option. In this case, aim for a loan with a rate and monthly payments that you’re confident you can manage over the loan’s term.

Defaulting on a loan has major consequences. It can significantly hurt your credit score, land you in court with more debt, have debt collectors coming after you and if in the long run you’re still unable to make payments, the bank can initiate bankruptcy proceedings.

3. How do I get the right personal financing for me?

Banks, cooperatives and credit agencies all have their own sets of qualification criteria for borrowers, and each offers different features. The right financing product will depend on your existing credit, income, debt and spending habits, as well as the reason you want to get a loan.

See also: 9 Major Differences Between Conventional Loans and Islamic Loans

Here’s what you need to consider:

- How much will it cost? The total cost of personal financing is expressed as an annual percentage rate (APR) in interest or profit rate (for Shariah compliant financing). Some lenders will charge additional fees like processing fee or membership fee (for co-ops). Financing is repaid in monthly instalments, so calculate your monthly payments to see how the loan fits into your budget.

- How will I know the APR? Lenders publish a range, you could use that as an estimate. However, banks will need to risk access you first before offering the actual rate.

- How fast do you want to repay the financing? Repayment terms are usually between two and five years. Longer repayment terms mean higher APR.

- How soon do you need the funds? Some lenders specialize in fast funding. They can fund your financing in the same business day or within a few business days after approval.

- What features are important to you? Some banks focus their loans on debt consolidation and send the funds directly to your creditors. Some may offer financing with a credit card.

Get matched to the right financing product HERE.

4. What are my chances of getting personal financing?

When your financing application goes in for processing, your credit score and debt service ratio (DSR) is a major consideration. These two are strong decisive factors and you need to make sure it’s good to prove to the financing officers that you have good credit worthiness.

Your credit score is derived in a credit report that is a compiled database of your credit and payment history that defines your financial health. If your credit score is low, banks might agree to extend you financing but at a higher rate than others.

Here are some major factors that impact your credit score:

- Payment behaviour with past credit lines: If you have missed repayments on your current or past credit lines, your credit score can drop and impact your future loan applications.

- Special attention accounts: If you have any non-performing loans in your name that is under the close supervision of the financial authorities, it might be bad news as far as your loan application is concerned.

- Amount owed through credit lines: Your credit score also depends upon the amount you owe the bank or financial institution through these lines of credit.

- Types and number of credit lines (secured and unsecured loans): Your credit score also depends upon the mix of credit lines you have i.e. secured loans like a car loan, and unsecured loans like a personal loan and credit cards.

- Length of credit history of every credit line: Your credit score is also dependent on the time you maintained or have been maintaining the credit lines for.

- Newly approved credit lines: Your credit score can take a hit if you have recently been approved a new line of credit.

- Credit limit: If you’ve maxed out your credit card or overdraft limits, chances are your credit score will take a hit and impact whether your loan application will be accepted or not.

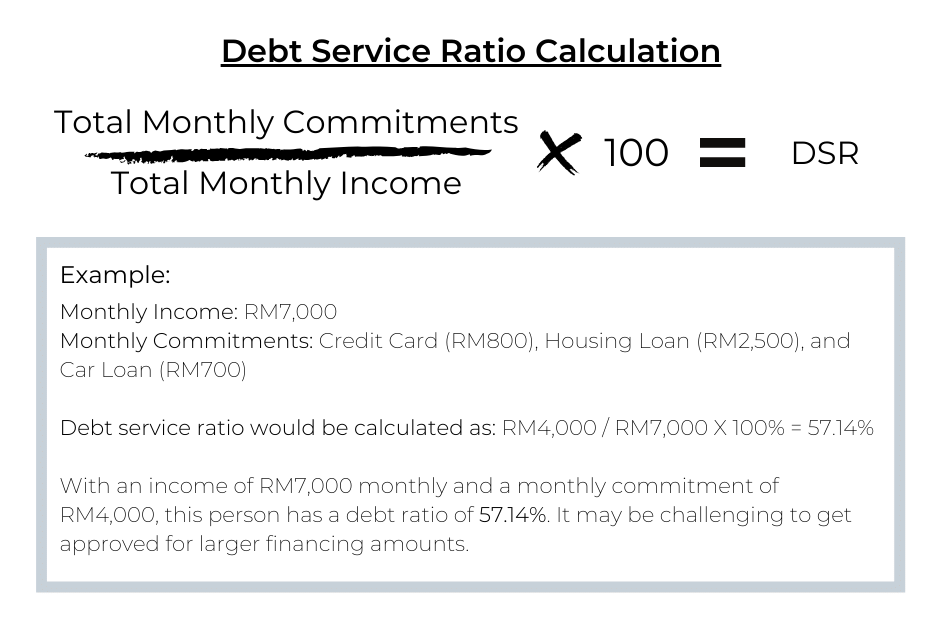

DSR, is a calculation used by the bank to check whether you can repay the loan. Your DSR is usually compared against the bank’s maximum allowable DSR limit. Safe to say, the lower the DSR, the better the chance that you can get your financing application approved. Best advice is you should always maintain your DSR within 30-40% range. Do take note that a DSR limit varies according to individuals and their respective levels of net income. A DSR is also known as debt-to-income (DTI) ratio.

5. Can I have more than one personal loan?

It is not advisable to have more than one personal loan. Usually, banks do not sanction two personal loans at the same time. Even if you are eligible for a personal loan from another lender, it’s not a good idea to apply for multiple personal loans at once.

Most banks and financial institutions keep track of the number of times you apply for financing, and more importantly, the number of rejected applications. Applying for a number of financing packages is often perceived as desperation, which doesn’t bode well with your chances of getting your loan approved. When applying for a loan, filter the banks and loan packages carefully and do not blindly apply for loans with a large number of institutions.

Keep in mind that lenders consider your credit history and repayment capacity while processing your financing application. In case more than half of your salary is going towards repaying debts, then lenders see you as a high-risk candidate.